It is the “Tax Season” as people call it! And as a responsible citizen and taxpayer, you need to know a bit about taxes and their importance. So that is exactly what we are going to discuss in this blog!

\

\

To understand the types of taxes, first we need to know the incidence and impact of taxes. Incidence of tax. The final burden of tax is known as tax incidence and the initial burden of tax is known as tax impact. Simply put, the person who actually pays the tax is said to be impacted by the tax and the person who first passed on the tax liability is said to be incidental.

Now that we know about incidence and impact of taxes, let us take a look at types of taxes-

- Indirect Taxes

The type of taxes where the incidence is on one person and the impact is on another. Indirect taxes can be passed on to others and usually make a lesser percentage of revenue. Examples of indirect taxes are excise tax, VAT, and service tax.

- Direct Taxes

In case of direct taxes, the incident and impact is usually on the same person. This is because the taxes are deducted at the very source. These taxes make up the majority of tax revenue of the government. TDS, Professional Tax, Income Tax, Property Tax, etc are all examples of direct taxes.

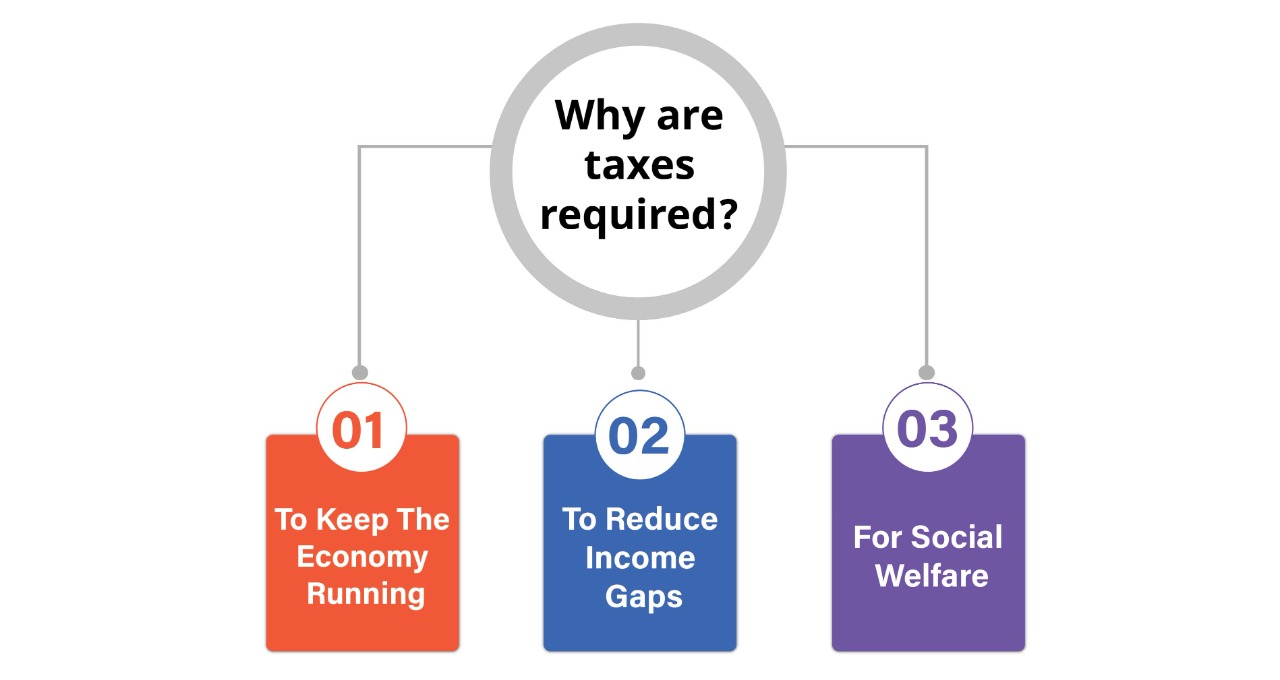

- Why are taxes required?

– To Keep The Economy running

Running the country requires a huge capital. This calls for a huge revenue and with a working population as enormous as India, the rate of taxes can be much less. And needless to be said, Taxes are a huge part of the government’s revenue and revenue is an essential element in keeping the economy running.

– To Reduce Income Gaps

Taxes are designed with the canon of equity in mind which says that a tax should be made in such a way that it should be equitable to the payers, i.e. less rate of tax for payers in the lower income group and higher rate for high income groups. This directly helps in creating equity among people and reducing income gaps in the population.

– For Social Welfare

The primary goal of the Government of India is social welfare. And to take up projects of social welfare, the government needs huge amounts of funds. Tax revenue makes up the majority of these funds.

In conclusion, Taxes in India are classified into two types- Direct and Indirect. Taxes are necessary as it is the major source of income for the government. The government uses these funds for the welfare of people which leads to economic growth and development. Now that you know why taxes are important, you might also want to know what your taxes as an employee, i.e TDS is, you can read What is TDS and things you need to know about it!