As the year end is nearing, people are rushing towards tax payments and savings. But what do you have to keep in mind as an employee? Know what is Form 16 and how is it beneficial for you as an employee.

What is Form 16?

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to Taxpayers.

Am I eligible for Form 16?

You are eligible for it if your salary is more than 2.5 lakhs per annum.

Contents of Form 16

The Form 16 contains all the details of tax payment like amount, Challan number, cheque number, Demand Draft number etc. Personal details of the employee, like name, Permanent Account Number (PAN) etc. Acknowledgement of the number of the taxes paid by the employer. Taxes deducted as per sections 191A and much more.

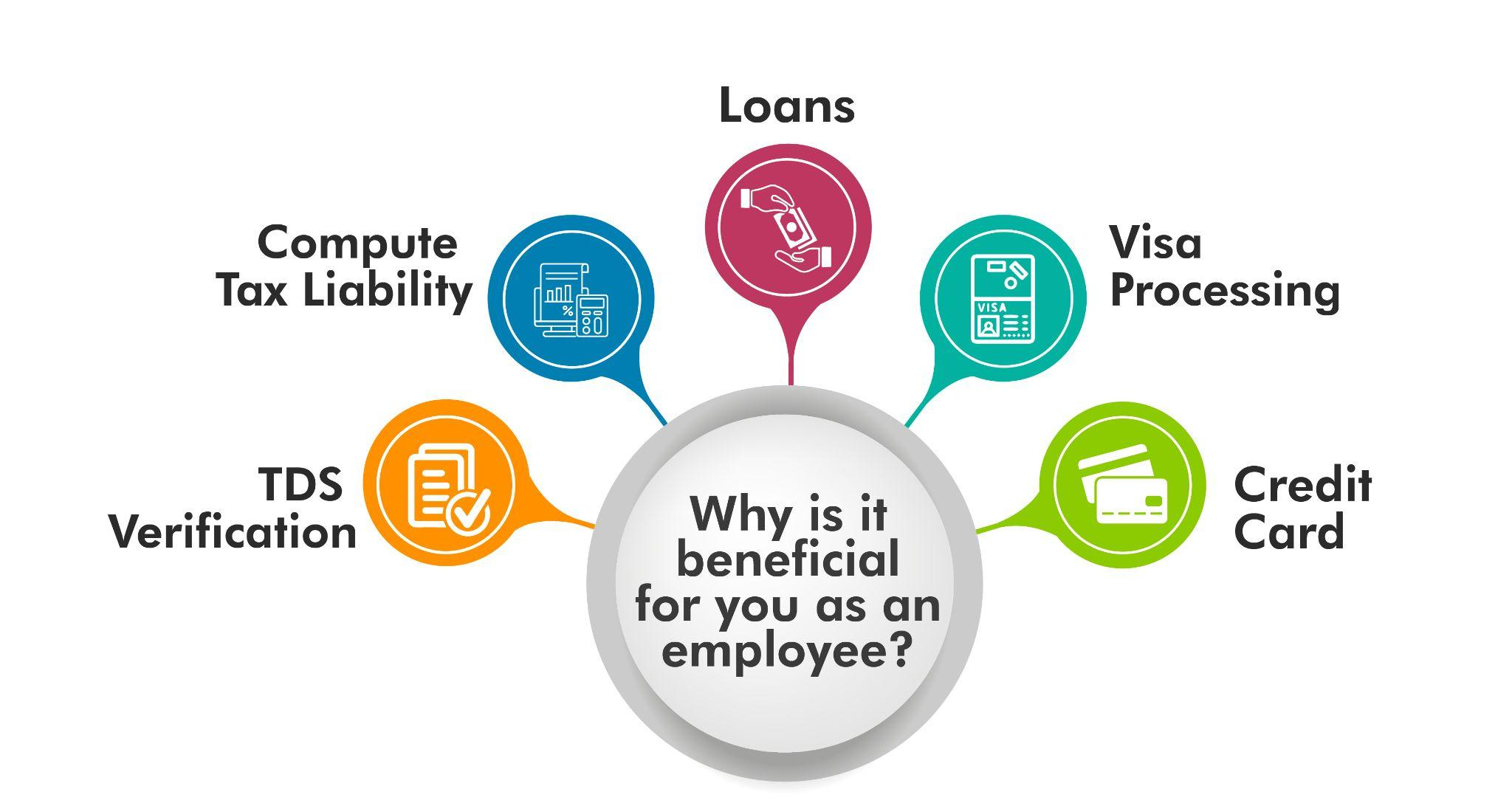

Why is it beneficial for you as an employee?

-

TDS Verification

Form 16 can only be issued when your employer has deposited your TDS in the central government account. This ensures that your employer has actually paid the TDS which was promised to be paid from your salary. It not only acts as a proof that you have paid the TDS but also is a surety that the TDS amount deducted from your salary and TDS amount deposited is the same.

-

Compute Tax Liability

Form 16 also helps you calculate your tax liability. This enables you to pay your remaining taxes in time or seek refunds by filing your returns on time. While the responsibility of TDS falls upon the employer, the employee has to make sure that his/her taxes are paid on time and he/she is not overdue.

-

Loans

When applying for a loan, be it home, vehicle or personal, one is asked for their income tax returns. it acts as a handy tool to provide your salary breakdown and tax liabilities which helps in the better assessment of your loan application. Form 16A and 16B combined also reflects your tax saving investments and any other investments schemes that may be leeching your money. Meanwhile it provides a good idea of your loan repayment ability to the lender as well.

-

Visa Processing

Along with income proof, many foreign embassies and consulates also demand for Form 16 of the past two years to get an idea of the financial stability of the particular salaried individual. This helps them assess if the individual can manage the finances of staying abroad.

-

Credit Card

Presenting the Form 16 of the past two years is crucial for an employee while applying for a credit card. Form 16 acts as an income proof which gives the financial institutions assess the applicant’s financial stability. These financial institutions also use it as a certificate to determine the credit limit of the applicant. Higher the income, higher the credit limit!

So, here’s how it helps you as an employee! The employer is bound by law to issue The Form 16 if your salary is more than 2.5 lakhs per annum. If you don’t receive it by mid-May, you should remind them to issue it at the earliest! While people usually struggle with the issuing of such forms and calculations of taxes, using Spine HR Suite will enable you to quickly access the form and calculate tax and salary swiftly. You can learn more about Spine HR Suite Here.

1 Comment

Simply wish to say your article is as surprising. The clearness in your post is simply spectacular and i could assume you’re an expert on this subject.

Fine with your permission let me to grab your feed to keep updated with forthcoming post.

Thanks a million and please carry on the enjoyable

work.