Form 26AS is a statement that provides details of any amount deducted as TDS or TCS from various sources of income of a taxpayer. It also reflects details of advance tax/self-assessment tax paid, and high-value transactions entered into by the taxpayer.

Form 26AS is a statement that shows the below information:

- Tax deducted on your income by all the tax deductors

- Details of tax collected by collectors

- Advance tax paid by the taxpayer

- Self-assessment tax payments

- Regular assessment tax deposited by the taxpayers (PAN holders)

- Details of income tax refund received by you during the financial year

- Details of the high-value transactions regarding shares, mutual funds, etc.

- Additional details like mutual fund purchase and dividend, interest on income tax refunds, off-market transactions, foreign remittances, salary break-up details, etc.

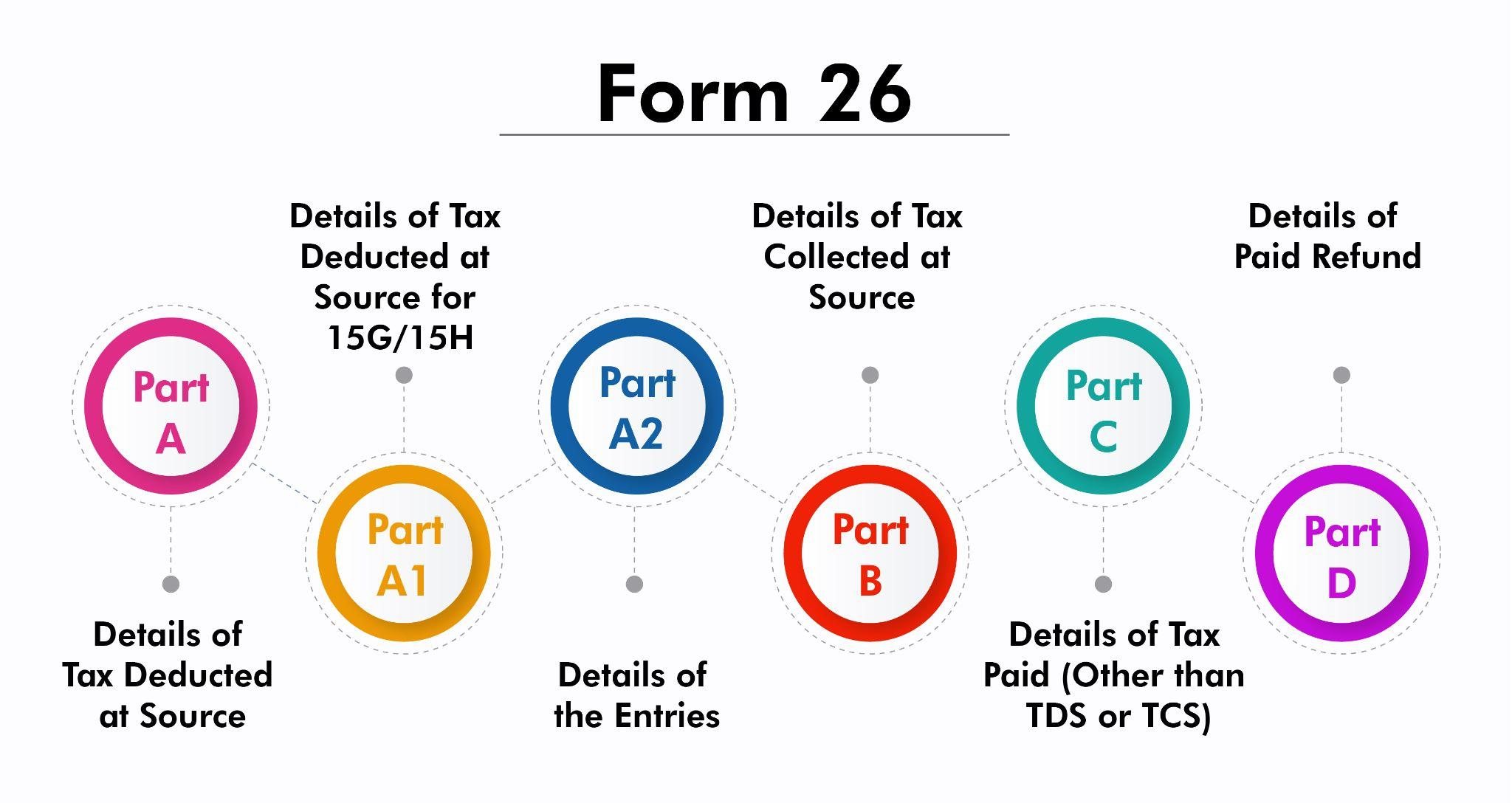

Following are the Components of Form 26:

Part A:

(Details of Tax Deducted at Source)

Part A of Form 26AS contains TDS details deducted on your salary, interest income, pension income, prize winnings, etc. It also includes the TAN of the deductor, the amount of TDS deducted and deposited to the government. This information is provided every quarter.

Part A1:

(Details of Tax Deducted at Source for 15G/15H)

Details of income where no TDS has been deducted is given here since the taxpayer has submitted Form 15G or Form 15H. You can verify the status of TDS deduction if you have submitted Form 15G or Form 15H. If you have not submitted Form 15G or Form 15H, this section will display ‘No transactions present’.

Part A2:

(Details of the entries are mentioned here:)

- TDS on sale of immovable property u/s194(IA) (for the seller of property)

- TDS on rent of property u/s 194IB (for the landlord of property)

- TDS on payment to resident contractors and professionals u/s 194M (for a payee of resident contractors and professionals)

That is, it will show entries if you have sold the property/rented the property, received payments for contractual or professional service during the year, and TDS was deducted on the same.

Part B:

(Details of Tax Collected at Source)

Part B shows the Tax Collected at Source (TCS) by the seller of goods. Entries in Form 26AS will show seller details who has collected tax from you.

Part C:

[Details of Tax Paid (Other than TDS or TCS)]

If you have deposited any tax yourself, that information will appear here. Details of advance tax as well as self-assessment tax are present here. It also contains details of the challan through which the tax was deposited.

Part D:

(Details of Paid Refund)

If any, information regarding your refund will be present in this section. Assessment year to which the refund pertains, along with the mode of payment, the amount paid and interest paid, and the date of payment are mentioned.

Aside from these, there are 4 more parts, namely E, F, G and H. But as an employee, parts A through D are necessary for you as they reflect your Taxes paid, payable, refunded and refundable. You can then, having a certain vision and clarity, plan your investments and file your returns.

If you are an employer and you are looking to make things like tracking and filing of TCS and TDS easier, in fact automated, Spine HR Suite is the tool you are looking for! With intelligent Payroll, Tax Calculator, Performance Manager, Regulatory Compliance tracker and many more useful features, Spine HR Suite is the one stop solution for all your needs!