“It is easier for a small organisation to process payroll manually.”

Many people think this and waver away from the idea of getting a payroll software. But there are many caveats to manual payroll which they are not aware of. In this blog, we are going to talk about these drawbacks.

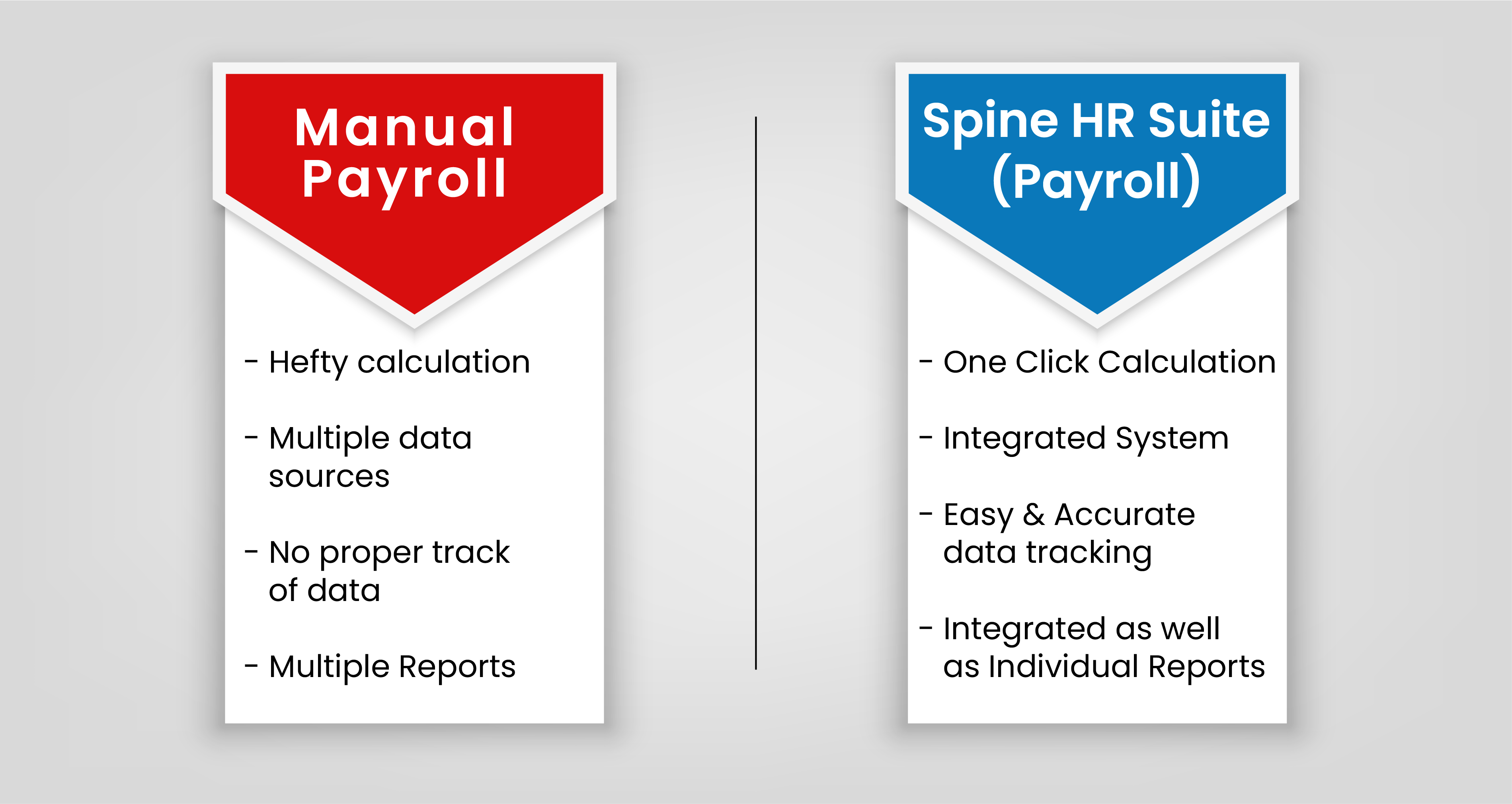

– Calculation

Keeping this very straightforward, calculation of salaries is a nightmare. Especially when you have to do it manually. Calculation of arrears, taxation, work hours and tallying attendance reports can get hectic. Sometimes even annoying. Being a growing organisation, you would not want to put your employees under such pressure. Immense workload is not good for employee wellbeing. On the flipside, implementation of an HRMS makes things much more easier. Spine HR Suite’s payroll module imports data from attendance and calculates the gross salary. You can then link it with the leave module. Input your tax compliances and get the Net Salary.

– Data Sources

Talking about manual payroll processing, there are usually more than one sources of data. Attendance sheet from one place, leaves from another and timesheet if you keep an hourly track. You would need information from several softwares and registers. But an HRMS, being integrated, will provide you with the necessary data. For example, Attendance when linked with payroll would transfer data from one module to another seamlessly. This would drop the hurdle of many data sources.

– Data Tracking

“Appropriate information from many registers to make a track in one more.” Manual payroll process can be summarised with this single statement. Data tracking becomes arduous when you have so many sources of data. Another challenge in manual payroll processing is reconciliation of data. As you are not very sure of where exactly the data is from, it becomes difficult to correct any errors. But with an HRMS, you always have a proper, defined data source. This makes tracking of data much simpler. HRMS lets you store data in your desired format and export it to your preferred accounting software.

– Reports & Analytics

Maintaining reports in manual payroll processing can be gruelling more than often. A report for every individual employee, department, group and the list keeps going on. And even if you manage to make the reports, interpretation becomes an issue. The reports have to be simple and interpretable by everyone who sees them. An HRMS lets you create customised reports. Employee, Department, Branch, Gender, Age group, you name it! Creating reports with Spine HR Suite is as easy as a few clicks.

There are many more benefits that an automated payroll solution like Spine HR Suite offers you. Disbursement of salaries directly in the bank accounts, payslip generation and auto-mailing and letter generation are a few of them.

In conclusion, an automated payroll is much better and economical for a smaller, growing organisation. You can read What is a payroll software and all you need to know about it here. And if you are looking for a payroll service, you would want to read 9 Essential features a payroll must offer here.

1 Comment

Thank you for sharing your knowledge. Your blog is a valuable resource for HR professionals!!