It is almost the end of the Financial Year 2021-2022. Which means, it’s the time to file your IT returns. So here are we, to your aid! Read to know how can salaried employees save taxes this year end?

First off, let us understand why paying income tax is important to you as a salaried individual. Below listed are the benefits you derieve from filing your IT returns:

- Better Loan Eligibility

- Easy Tax Refunds

- Easy Claim of Tax Deductions

- Avoid Tax Penalties

- Better Visa Application Processing

These are just some benefits of filing Income Tax Returns. But you know what else is important? Saving Taxes! Because who doesn’t like Tax Saving and investments?

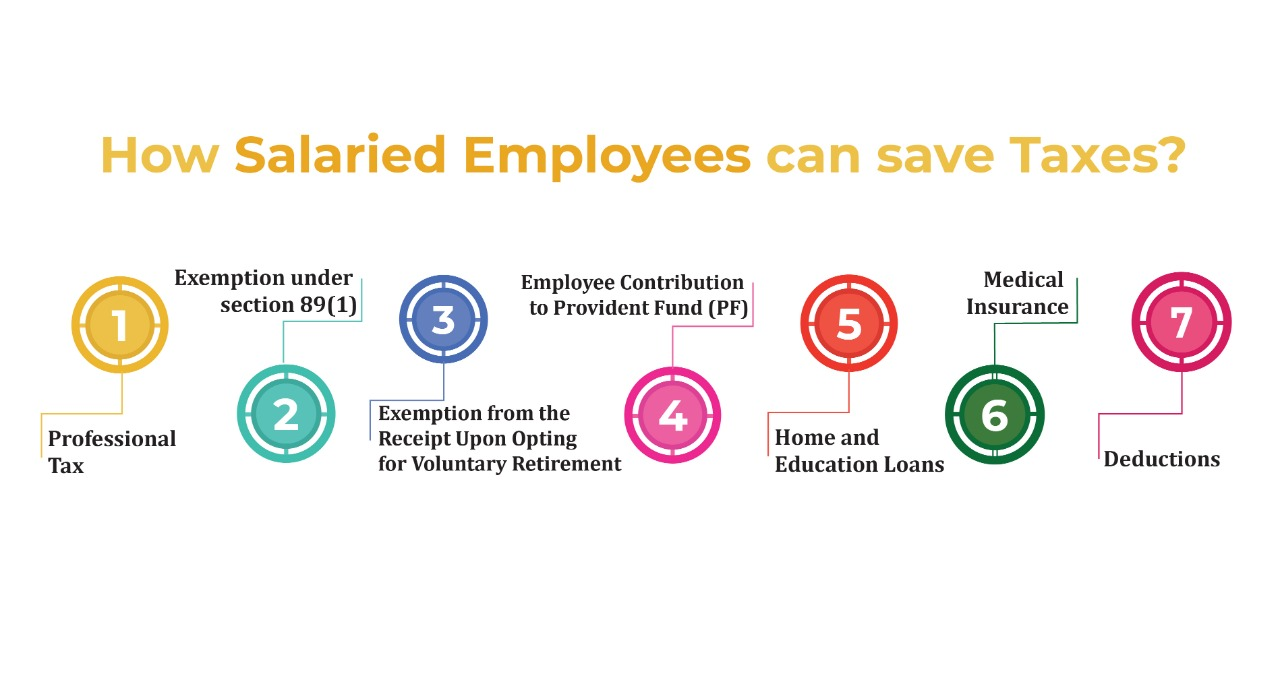

Here are some ways in which you can save taxes as an employee-

-

Professional Tax

As Professional Tax is levied by the state government and is deducted from your gross salary, you do not need to pay it again from your net income. Professional Tax is usually rupees 2500 and is deducted by the employer at the time of disbursement of salary.

-

Exemption under section 89(1)

As per section 89(1) of the Income Tax Act, Salary received in arrears or advance is allowed for relief in taxes.

-

Exemption from the Receipt Upon Opting for Voluntary Retirement

As per Section 10(10C), any compensation on voluntary retirement or separation is exempted from tax. The exemption is subjected to the pre-requisite that the receipts comply with rule 2BA. Also, the maximum compensation received should not exceed Rs. 5,00,000.

-

Employee Contribution to Provident Fund (PF)

The PF is usually is 12% of the basic salary. The government decides the interest rate which is about 8.65%. Therefore, upon maturity, the returns are exempted from tax. Also, EPF contributions can be claimed for tax exemption under Section 80C of the Income Tax Act.

-

Home and Education Loans

You can claim a tax deduction for interest on a home loan of up to Rs 2,00,000 in a financial year under section 24. Moreover, you can claim the tax deduction of principal amount repayment under section 80C of up to Rs 1.5 lakhs.

You can claim a tax deduction against the interest on education. Such interest must be paid out of your income chargeable to tax for the financial year.

-

Medical Insurance

A salaried employee can claim a deduction against the medical insurance under section 80D. Such medical or health insurance must be taken to cover their spouse, dependent children, or parents. You can claim Rs 25,000 against insurance premium paid towards to cover their spouse, dependent children.

-

Deductions

Every month, the employer deduct a part of your total income tax as Tax Deducted at Source (TDS). This is a significant portion for a salaried employee. Furthermore, the employer provides details of the tax deducted in Form 16 (TDS certificate). You can learn more about Form 16 here.

You know what else can help an organisation save and calculate taxes? Implementation of an HRMS! If you are looking for an HRMS, Spine HR Suite is the one stop solution for you!