Do not be afraid of “Asset Lifecycle” it is not as complicated as it might seem!

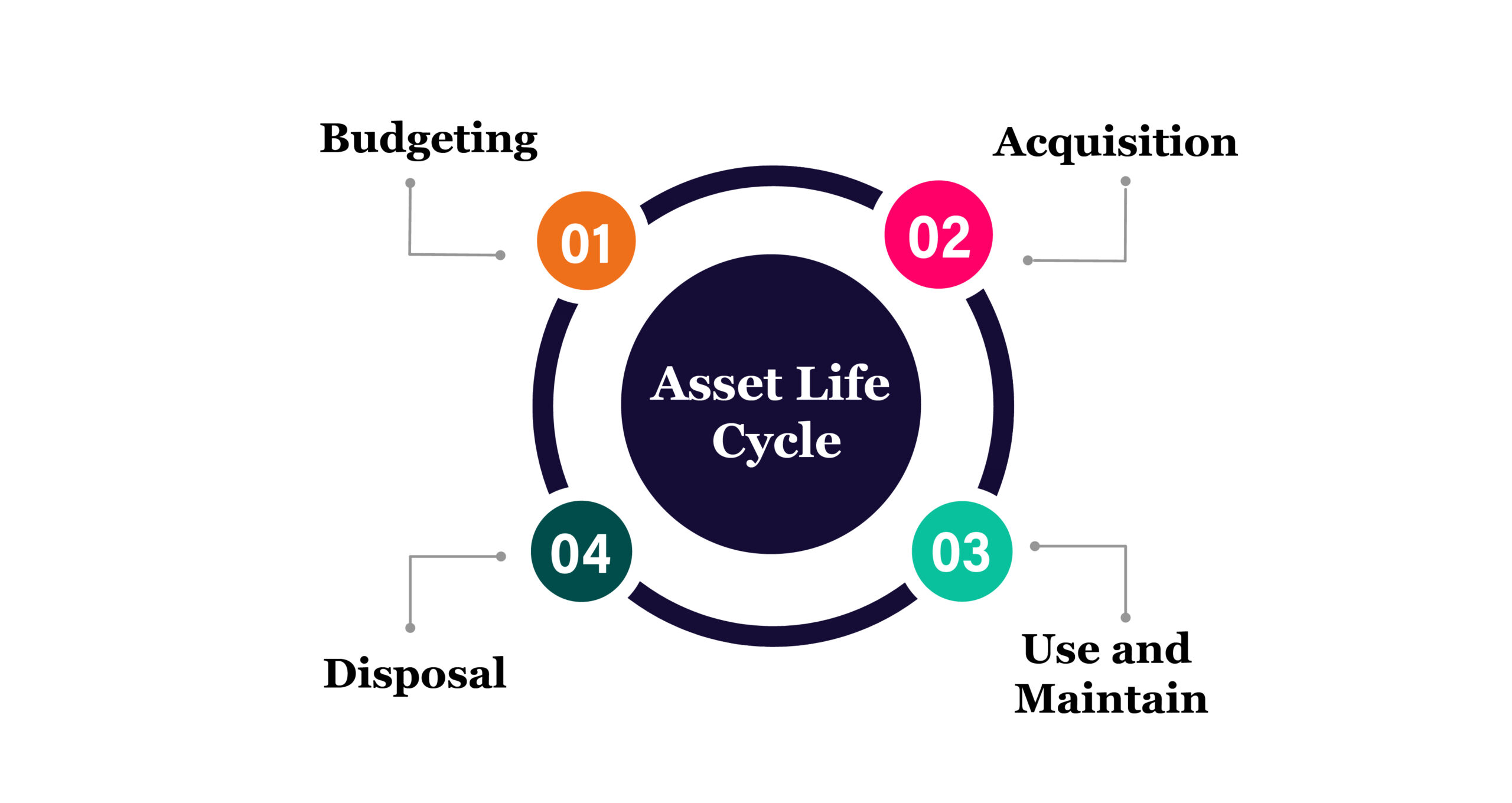

Let us start by understanding what asset life cycle exactly means. Stages involved in the management of an asset is known as asset life cycle. It starts with the planning stages when the need for an asset is identified, and continues all the way through its useful life and eventual disposal.

Following are the four stages of an asset life cycle:

– Budgeting

– Budgeting

As soon as you realise the need to buy an asset the role of a Fixed Asset Management System starts. This is the first phase- Planning. The next phase is actual budgeting. Asset budgeting enables you to enter new assets into the budget as efficiently as possible while still giving the budget coordinator the control to ensure accuracy of asset data entry. An FAMS lets you maintain an automated, on cloud record of your planned and budgeted assets.

– Acquisition

Asset acquisition refers to the actual purchase of assets. Asset Acquisition, with an FAMS makes this easier as it allows you to automatically record the new asset. Recording the new asset lets you track the asset more efficiently and barcode labelling is just the cherry on top! You can read 4 Benefits of Barcode Labelling your Fixed Assets! To learn more about barcode labelling.

– Use and Maintain

Now this is the third, longest and the most important stage in the life cycle of any asset. The usage and maintenance of assets require special attention be it servicing or renewal for digital platform assets. Also read How does a FAMS help in managing IT Infrastructure? A Fixed Asset Management System lets you categorise, group, track and record assets and asset transactions. You can get usage reports, notifications and reminders, etc. at the dashboard itself. You can assign assets to employees, get information about the asset and much more. All you have to do is just scan the assigned barcode/ QR Code/ RFID tag.

– Disposal

– Disposal

When assets are in a nonproductive stage and no longer able to fulfil its primary objective then they need to be disposed. It is the last stage of the asset life cycle. Asset disposal is the process in which long term assets are eliminated from the account records and sold at disposal value. Disposal of assets need to be tracked accurately as it directly affects the organisation’s books of accounts. There is no room for calculation errors and hence, automating it is the best way of getting rid of any!

In conclusion, The four stages of the life cycle of any asset are-

- Planning and Budgeting

- Acquisition

- Use and Maintain

- Disposal

If you are looking for an end-to-end Fixed Asset Management Solution, Spine Assets will get all your ends covered! You can learn more about Spine Assets here.