Here comes that time of year that both employees and employers dread. Yes, you guessed it right! The end of the financial year. It is probably the most stressful time that sends many employees into a frenzy. It is when employees need to calculate year-long taxes, they need to shell out. In India, you may have to pay a considerable proportion of your income as tax. The end of the financial year is around the corner, and it is time to assess our income for tax calculation. But fret no more! The saying goes, “a penny saved is a penny earned.” We have brought you some highly effective methods to save your tax on your capital gains tax or even tax-free income to make the most of your salary.

The beginning of the assessment year for income tax e filing will commence shortly. However, several employees are clueless about finance and IT e-filling. In this blog, we will answer common questions such as: What are the particulars in form 16? What are TDS, GST and VAT? Why does HR ask for several declarations at the beginning of the year? We aim to familiarize you with most of these concepts in the blog.

Paying close attention to save your tax might help you keep a good deal of money for yourself. Income Tax Department requires you to display your income every year. Before we talk about the different ways to save your tax, let us know more about the components that our salaries consist of:

- Basic Income

- House Rental Allowance

- Special Allowance

- Leave Travel Allowance

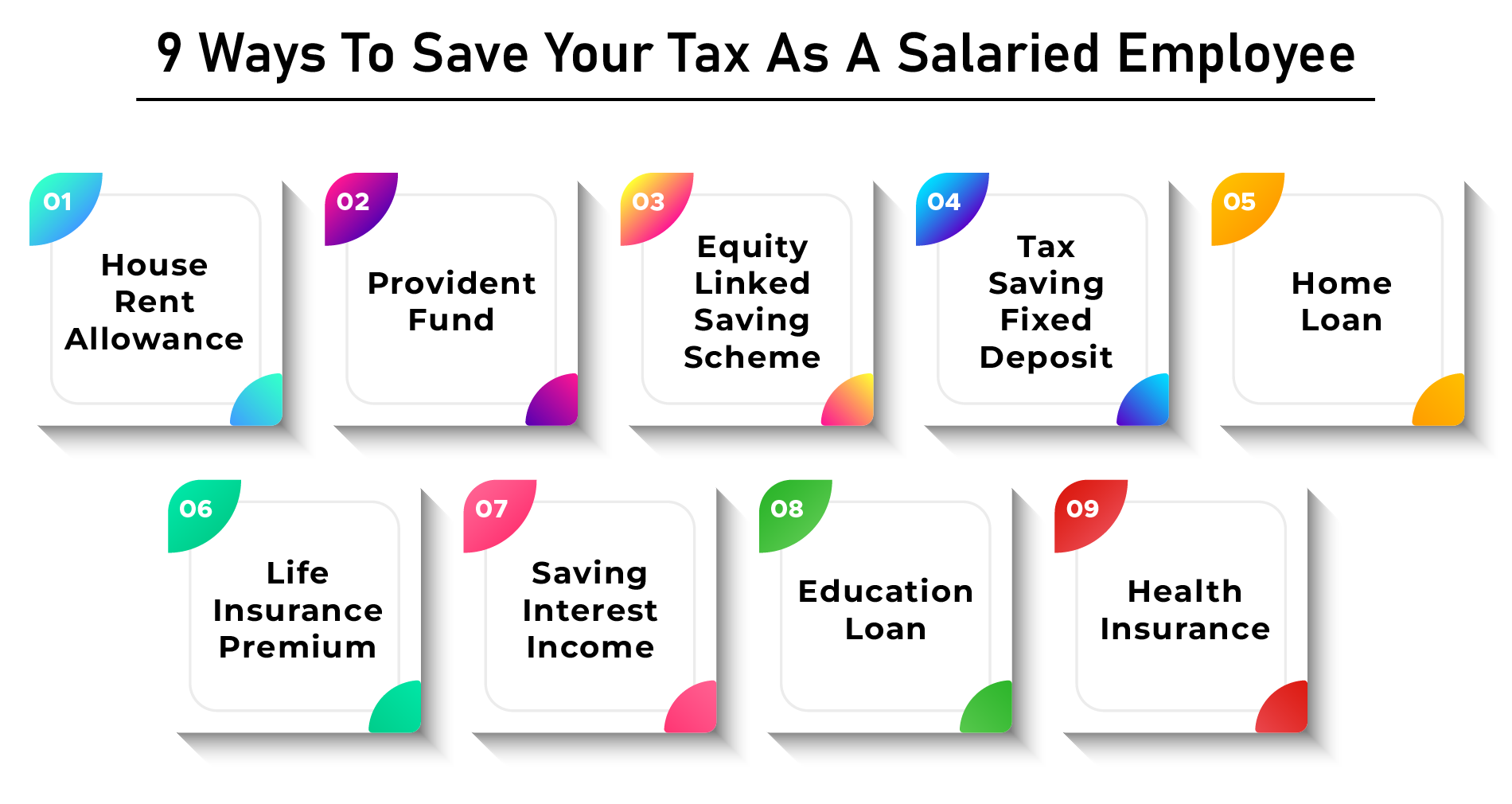

These components sum up your gross salary. Then comes deduction, which is essential to plan well to save your tax on your income. Since we have our foundation cleared, let’s come to the point. Here are some ways to save your taxes on income:

House Rental Allowance:

Basic income generally amounts to 30-35% of our total income. There are three formulas for HRA, such as:

- The house rent allowance is the basic amount

- 40% (for non-metro city residents) or 50% (for metro city residents) of your basic salary.

- The actual house rent without 10% of your basic income.

The least out of the three is considered a deduction from the HRA amount. You don’t need to worry about these calculations as you can easily do them with a tax calculator. In addition, under Section 80 GG, you can claim your housing rent even if it is not mentioned on your salary slip.

Provident Fund:

Section 80 of the Income Tax Act gives you multiple deductions to reduce your taxable income as much as possible. Under Section 80 C, you can deduct up to Rs 1.5 lakh every year from taxable income. A salaried employee income plan has the component of a provident fund. The contribution of your Provident Fund can be added to this deduction.

Equity Linked Saving Scheme:

If you have invested in an ELSS or Equity Linked Saving Scheme, you can invest in a mutual fund for three years. Their investment is locked for three years so that you can avail of tax benefits from the government. It is a way of government to encourage citizens to invest in mutual funds.

Tax Saving Fixed Deposit:

It is one of the most popular savings options, as it can allow your money to work for you in several ways. Such kinds of FDs have a lock-in period of 5 years. Here, you can claim tax deductions on your tax-saving FD under Section 80 C.

Home Loan:

If you have availed of any home loan, it can also help you with the tax deduction on your income. The principal amount you have paid on your home loan in that year can also be claimed for deduction.

Life Insurance Premium:

Getting life insurance has become inevitable in uncertain times. According to Section 80 CCC, your life insurance premium can also be deducted from your total tax payable income.

Saving Interest Income:

This applies to the interest that you earn from your savings account. You can claim up to 10,000/- for your tax deduction. Thus, it is interesting that your simple savings account investment can also contribute to your tax deduction.

Education Loan:

Section 80 E relates to the deduction for the repayment of Interest on Education Loans up to 8 years. It is a long period to pay off your loan. So, it can be beneficial to you in several ways.

Medical Insurance:

The sedentary lifestyle, unhealthy choices and irregular cycles, and other environmental factors have resulted in a rise in several health conditions. Health insurance has been a necessity in modern times. However, it is possible to claim deductions for premiums paid under Section 80 D deduction. Up to Rs 25,00 can be deducted if the insurance is for your spouse, children, and yourself. Another 25,000/- limit can be added to the deduction if you include your parents under 60 years of age in the scheme. A further 50,000 is added if your parents are over 60 years old. In addition to providing you with insurance, it also allows you to save on taxes simultaneously.

It is vital to save your tax with the same discipline as your investment. Make sure that you claim your deductions extremely diligently in order to avoid unnecessary stress and hassles at the end of the financial year.

2 Comments

A fascinating discussion is definitely worth comment. I do believe that you need to publish more on this issue, it may not be a taboo subject but typically people don’t talk about such topics. To the next! All the best!!

Everything is very open with a clear explanation of the challenges. It was really informative. Your website is extremely helpful. Many thanks for sharing!