A payroll system is a software to automate the payroll process. These systems can be integrated with leave and attendance tracking systems and employee self-service portal and are used to keep track of employee’s working hours, calculate salaries, calculate taxes and deductions, print payslip, etc.

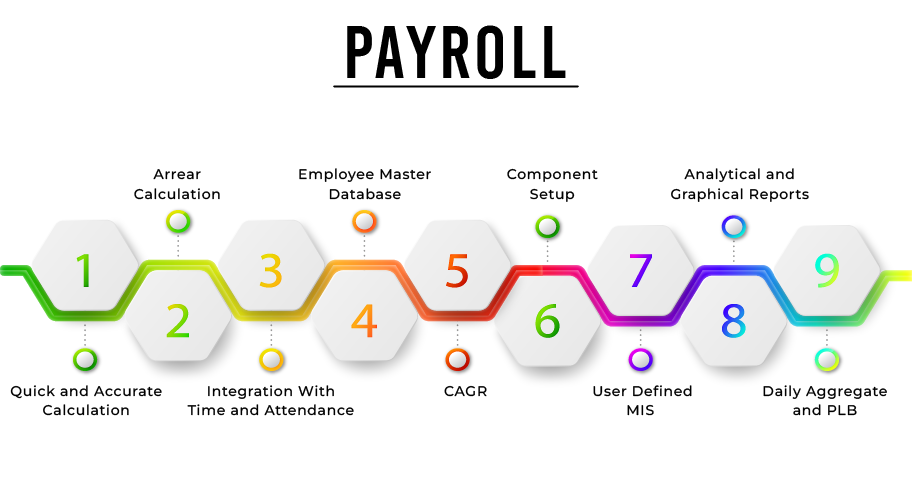

Now, talking about an all round payroll system, here are the 9 features that an efficient payroll must have:

1.Quick and Accurate Calculation

1.Quick and Accurate Calculation

If it was not obvious, a good Payroll system must be efficient, quick and accurate in providing calculations. The primary function of a payroll is to make accurate calculation of salaries and wages easier for the accounts department and quick disbursement of the same for the HR Department.

2.Arrear Calculation

Another important factor to keep in mind while calculating salaries and wages is to consider outstanding and/or advance payments or commitment of the same. An efficient payroll solution shall help you with arrear calculations which would work in favour of both you as an employer and your employee.

3.Integration With Time and Attendance

Integration with Time and Attendance is another basic necessity of a payroll. To function efficiently, a payroll requires a report of employees’ attendance, leaves and shifts. This is required in order to calculate the employee’s salary based on the days filled in by them.

4.Employee Master Database

An efficient payroll system must be enabled by a strong employee master database. Employee master consists of all the necessary information about the employee like bank details, contact number and much more. An Employee Master is a crucial element of a payroll and the user must be able to easily create, edit and retract employee master databases.

5.CAGR (Compound Annual Growth Rate)

5.CAGR (Compound Annual Growth Rate)

A feature that not many payroll systems offer is calculation of CAGR or Compound Annual Growth Rate. It refers to the growth a particular employee has made over the course of the year. This feature is necessary as it helps track employee progress and also helps in deciding whether the employee should be incentivised or not depending on his work.

6.Component Setup

A good payroll system must allow the user to create their own sets of CTC structure and breakdowns which vary greatly from industry to industry and company to company. This also helps in quick salary calculation as employees can be grouped under a CTC Structure designed specifically for them.

7.User Defined MIS

MIS reports are essential for the employer as well as the employee. Payslips, Reports, Letters and other important documents are available in just a few clicks given that the payroll system is efficient. This makes the employee self sufficient and HR Empowered as well.

8.Analytical and Graphical Reports

Can we all collectively agree that reports are crucial to an organisation? Be it employee performance reports, annual expense reports, annual growth reports or salary reports and breakdowns of employees a good payroll system should generate these in a matter of seconds. Even better if the system allows you to filter through the reports and drill down to a particular designation in a particular department.

9.Daily Aggregate and PLB

One more not-so-common feature in a payroll is Daily Calculation of wages. There are numerous organisations which provide employment on a daily wage basis. Calculation of such wages can be hectic and sometimes even more complicated than the traditional method if done by a non-efficient payroll. But a dynamic payroll solution will help you pacing up this process.

On an ending note, one should look out for a Payroll which allows flexibility to the user. A dynamic payroll is the one which allows user personalisation in every aspect while being standardised enough to be segment agnostic. Spine HR Suite offers you a payroll which checks all the 9 boxes and ensures the best in class payroll processing experience.