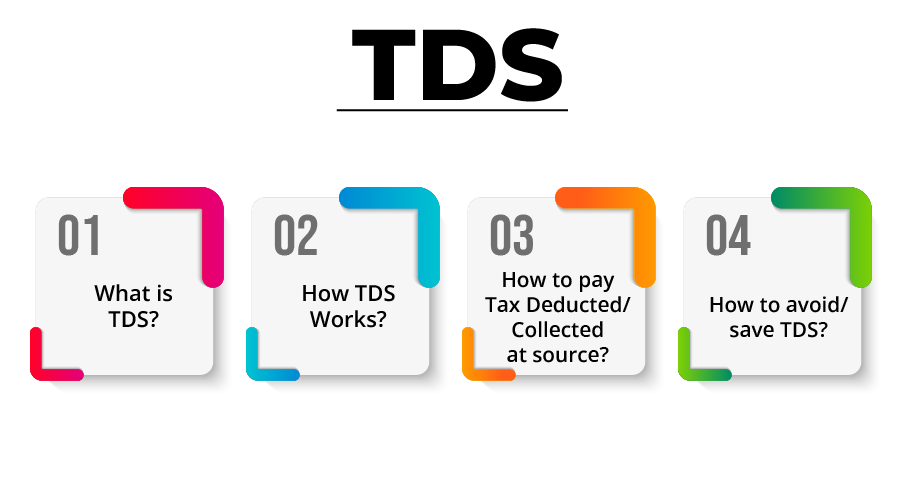

Wondering what is the “TDS” row in your salary slip? Or want to know more about what is TDS? If yes, then this is the blog you’re looking for! So without further discussion, let’s start by know what exactly is TDS?

-

What is TDS?

TDS is an abbreviation for Tax Deducted at Source. The concept of TDS was introduced to streamline the tax collection process by collecting the taxes at the source itself. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government. The deductee from whose income tax has been deducted at source would be entitled to get credit of the amount so deducted on the basis of Form 26AS or TDS certificate issued by the deductor.

-

How TDS Works?

TDS works on the concept that every person making specified type of payments to any person shall deduct tax at the rates prescribed in the Income Tax Act at source and deposit the same into the government’s account.

The Deductee can, thus, view or check the TDS from incomes paid to him by viewing the Form 26AS. Each deductor is also duty bound to issue a TDS certificate certifying how much amount is deducted in the deductee’s name and deposited with the government.

-

How to pay Tax Deducted/Collected at source?

Tax deducted or collected at source shall be deposited to the credit of the Central Government by following modes:

- Electronic mode: E-Payment is mandatory for

- a) All corporate assesses; and

- b) All assesses (other than company) to whom provisions of section 44AB of the Income Tax Act, 1961 are applicable.

- Physical Mode: By furnishing the Challan 281 in the authorized bank branch

-

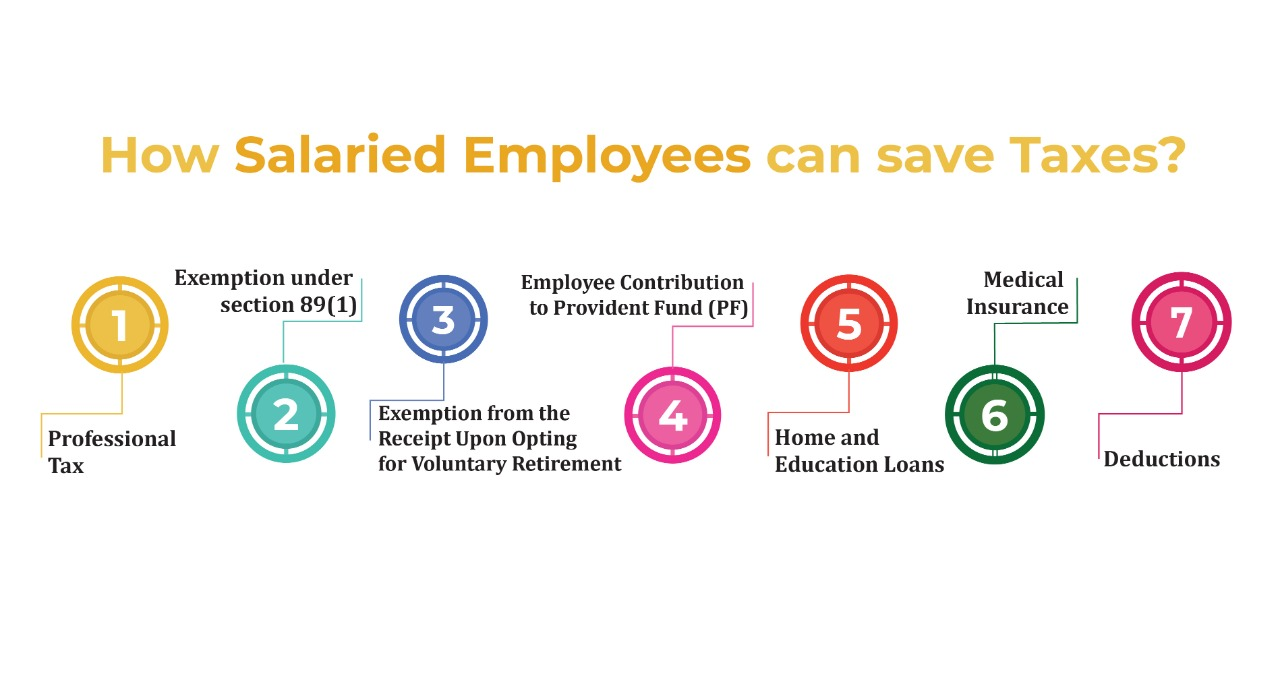

How to avoid/save TDS?

There is no absolute way by which you can avoid TDS. It is the duty of a professional to pay Tax Deducted at Source. The only way one can dodge Tax Deducted at Source is if his/her income is below the prescribed level of income that is rupees 2.5 laks for citizens under 60 years of age residing in India.

In Conclusion, a professional who is eligible for, is obligated to pay Tax Deducted at Source (TDS). There is no need for the employee (deductee) to stress about TDS payment as that is the the duty of the employer (deductor). If you are eligible to pay TDS, you should ask for your TDS certificate right now if you haven’t received it yet!

In Conclusion, a professional who is eligible for, is obligated to pay Tax Deducted at Source (TDS). There is no need for the employee (deductee) to stress about TDS payment as that is the the duty of the employer (deductor). If you are eligible to pay TDS, you should ask for your TDS certificate right now if you haven’t received it yet!

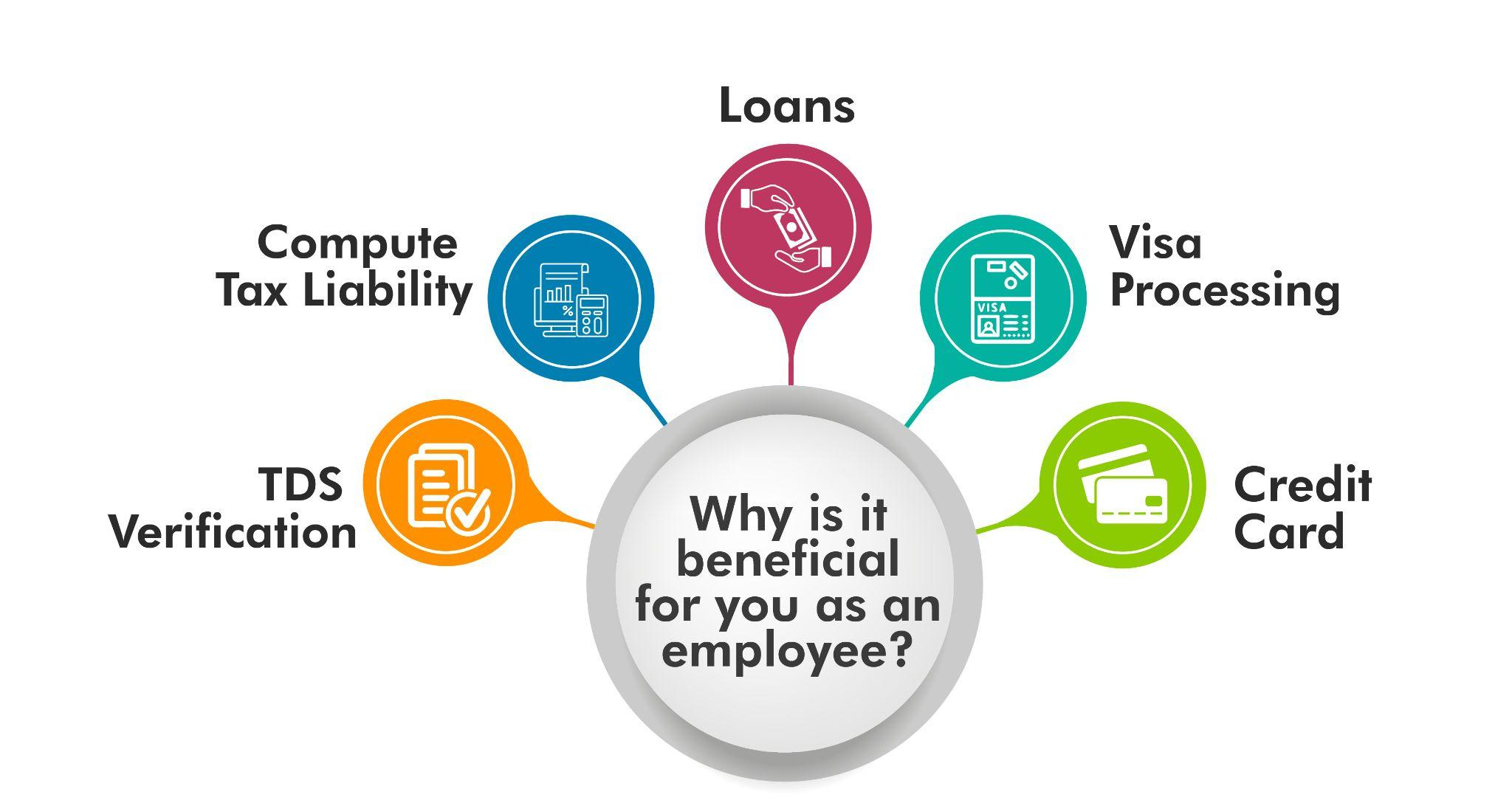

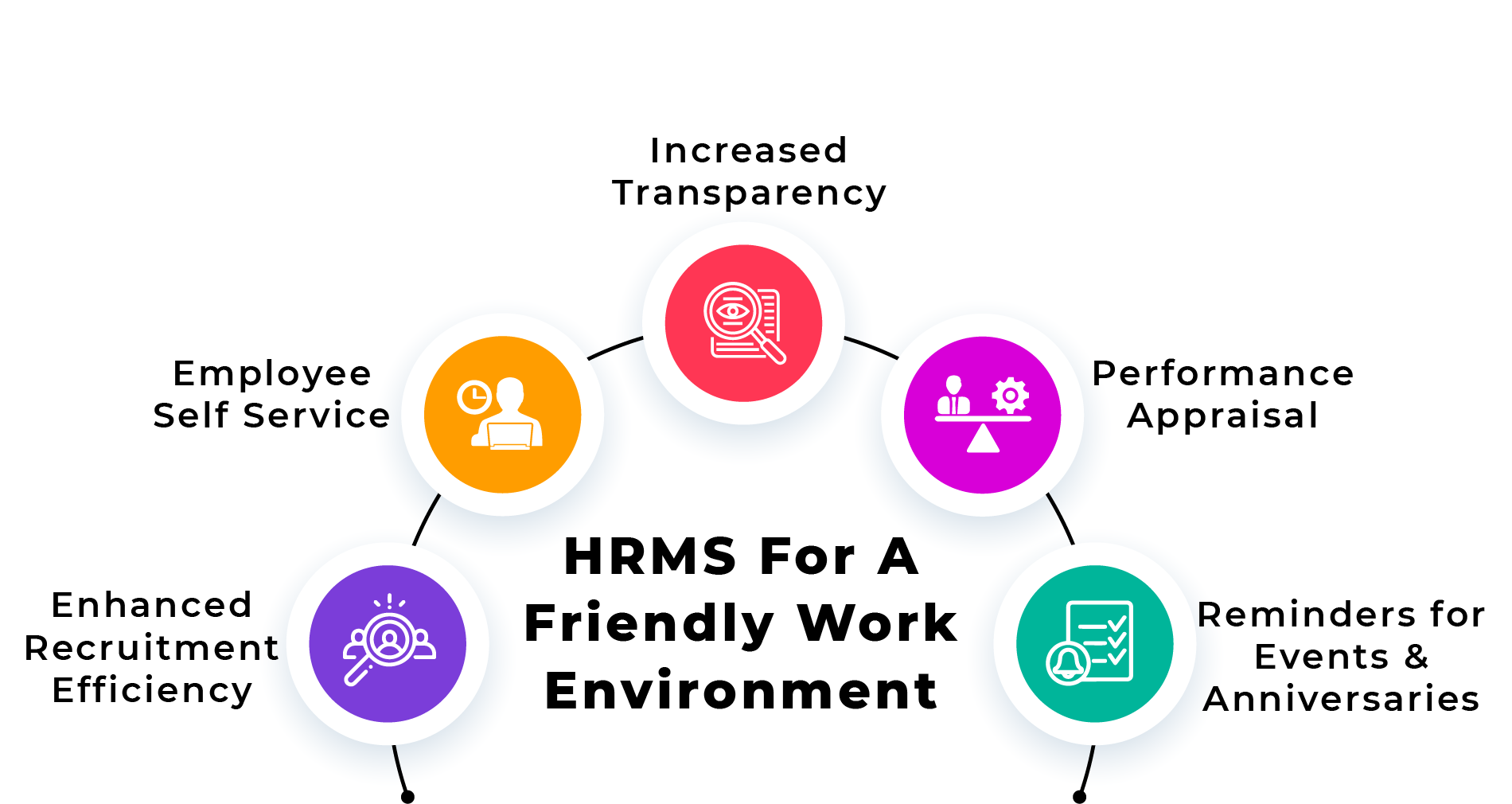

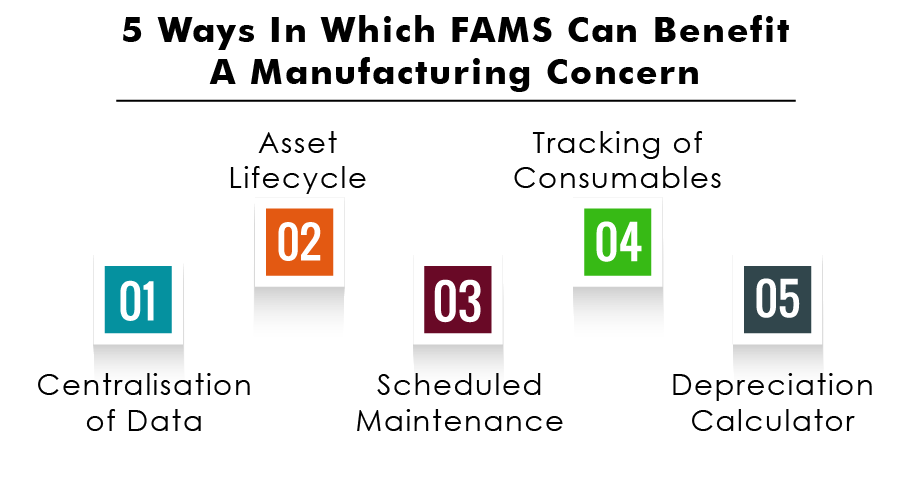

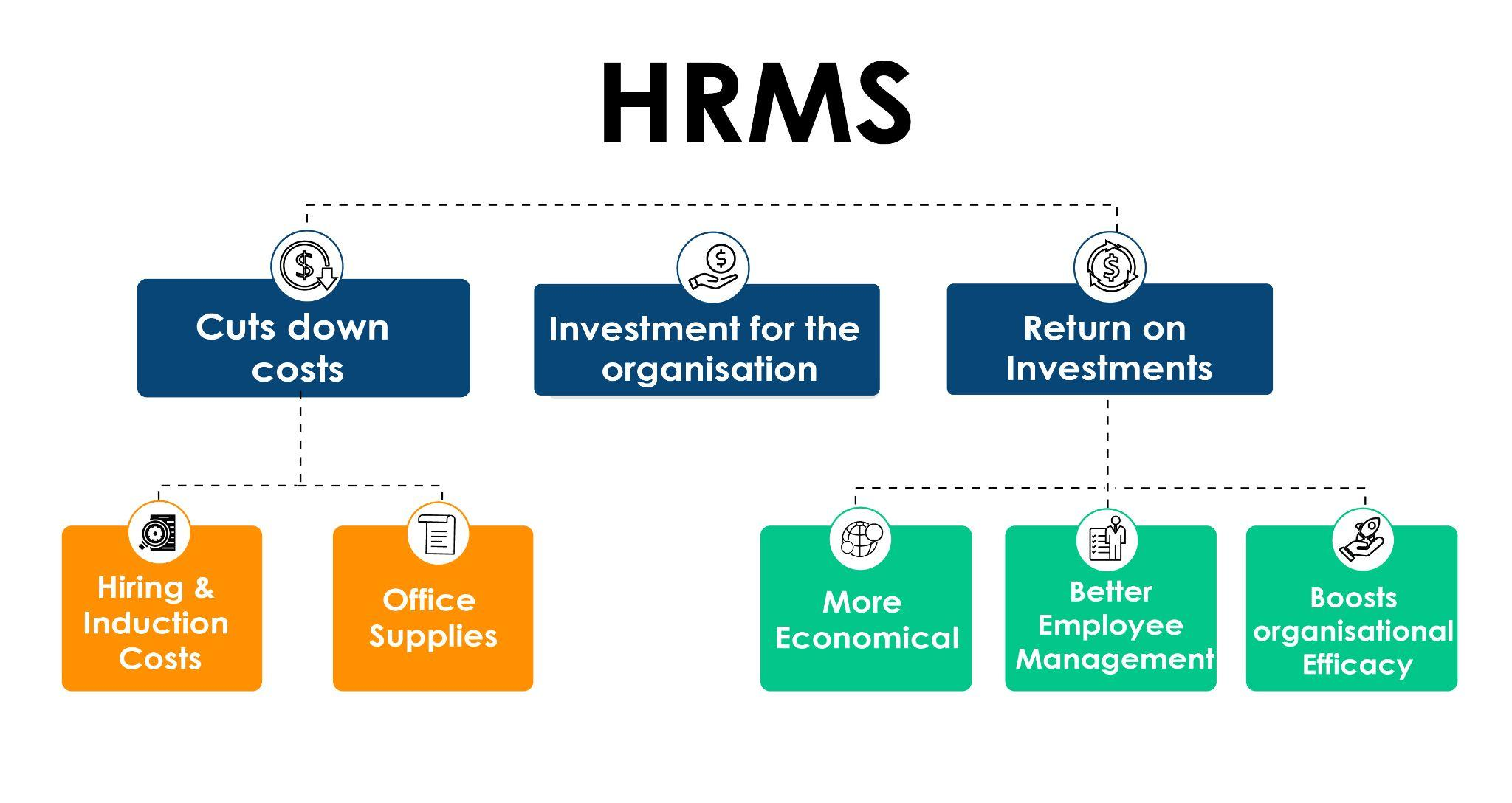

Are you an employer and are confused and stressed out about the year end hassles? Well then, Spine HR Suite is the pain killer you’re looking for! Not only you can calculate payroll, regulate attendance and automate all the HR Processes while cutting down the costs, you can also stay in lone with the government guidelines, compare the old regime and new regime and then alculate your taxes accordingly! And the best lart about it, everything is at just one place! You can learn more about Spine HR Suite here.